As the controlled shutdown of the economy becomes protracted, large numbers of businesses are increasingly at risk of bankruptcy and dissolution. Some will simply disappear, risking an increased homogenization of our main streets and local economies. For others, waiting in the wings is vulture capital, predatory private equity funds looking to acquire valuable but distressed assets for pennies on the dollar. CNBC reports that this group, which includes “investment giants Blackstone, Carlyle and KKR, has a record $1.5 trillion in cash ready to deploy” for the “unique opportunities to invest” in a post-crisis buying spree.

This would cause a massive funneling of ownership and wealth upward to already rich top elites. What’s the alternative? Under normal economic conditions, one avenue for preserving small and medium-sized enterprises might be employee ownership conversions or shifting to other forms of community-based or local social enterprise. But such conversions only work with viable going concerns—and in any case, the capital that’s needed is hardly present under the current economic conditions. Nor do we want to burden a new cohort of worker-owners with unsustainable enterprises or unserviceable debt.

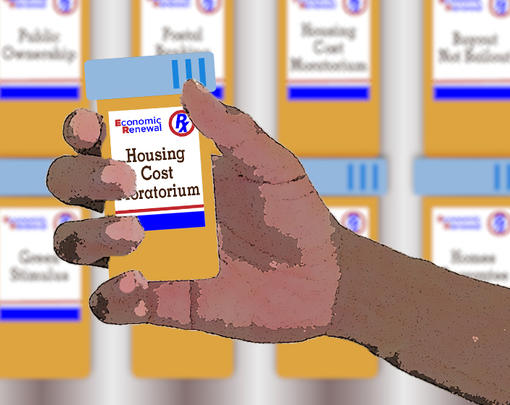

What is required now is a bold blocking move to prevent leveraged buyouts and corporate takeovers of what is left of Main Street America: A state holding company would acquire failing companies and distressed assets in this shutdown period, during which we are essentially operating what amounts to a siege economy. These businesses would be mothballed until recovery begins and the economic stimulus kicks in.

There are many models for this, including, most famously, the Reconstruction Finance Corporation (RFC) of the 1930s. This public holding company was set up to acquire failing businesses until they could be relaunched during the recovery from the Great Depression. Under the New Deal, the RFC became not only the biggest bank in America but also the single largest investor. There have already been calls to establish a Coronavirus Finance Corporation in the United States, and the research arm of the International Monetary Fund has also speculated that something like this may be necessary. If the political environment makes this impossible at the federal level, such entities can be created by states instead.

Not having it risks the large-scale collapse of the small-and-medium-business sector, with private equity vacuuming up their pick of failing enterprises and further concentrating corporate ownership and power. The future would be owned by Amazon and other behemoths of the corporate economy. Only massive government intervention can prevent this.